Understanding the Role of Inflation

Before delving into the specifics of art as an investment during inflation, it's vital to understand the concept of inflation. Inflation represents the rate at which the general level of prices for goods and services is rising, consequently eroding purchasing power. The purchasing power of a unit of currency falls, meaning you would need more currency to buy the same amount of goods or services.

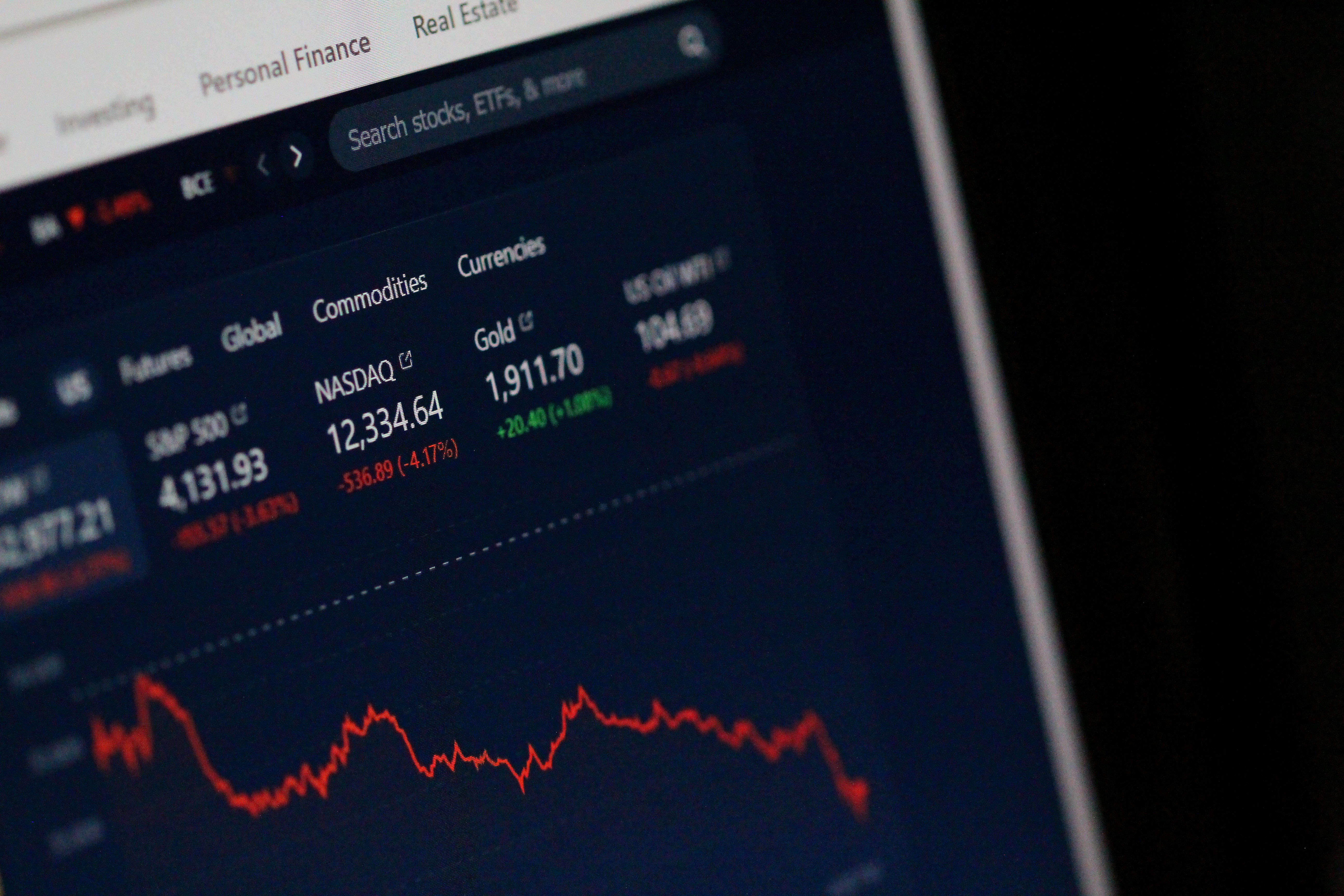

When inflation is high, traditional savings and fixed-income investments like bonds can be less attractive as their returns might not keep up with rising prices. On the other hand, assets like real estate, commodities, stocks, and as we will explore, art, can serve as viable hedges against inflation.

Art as an Asset Class

Art as an investment is often overlooked because of its unique nature. Unlike stocks or bonds, art doesn't generate cash flows like dividends or interest. However, the value of art tends to rise over time, making it a capital appreciation investment. The art market often behaves independently of traditional financial markets, which lends it the distinct advantage of offering a buffer against economic downturns and, notably, inflation. Photo by Anne Nygård on Unsplash

Photo by Anne Nygård on Unsplash

During inflationary periods, the prices of artworks, similar to other hard assets like gold or property, can increase. It's important to remember, however, that the art market isn't uniform, and not all types of art will experience the same demand or price growth. Rarity, artist reputation, provenance, and quality all factor into an art piece's value and its potential as an investment.

Art in the Inflationary Context

With higher inflation, tangible assets become more valuable because they retain their value despite the decrease in purchasing power of the currency. As the cost of living rises, so too does the price of art, particularly works by established and well-recognised artists.

Moreover, in periods of inflation, as investors look to reallocate assets away from cash and bonds, demand for alternative investments, such as art, often increases.

Art, however, is not a liquid asset; selling it might take time and involves transaction costs. While it might offer high returns, the returns can be irregular. Artworks are subject to fashion and taste, which can fluctuate significantly over time. Furthermore, expertise is required to understand the market and to authenticate and appraise artworks accurately.

Investing in Art: A Balanced View

Investing in art during inflation, thus, should not be seen as a panacea for inflation-induced financial woes. While the potential for high returns exists, so too does the potential for significant losses. Art investment is more suitable as a part of a diversified portfolio, spreading the risk across different types of assets.

Art also has benefits beyond the purely financial. It can offer personal enjoyment and societal prestige, and it can contribute to cultural preservation. The aesthetic value and emotional resonance of an art piece may offer a kind of 'dividend' that other investments cannot.

Inflation is a complex economic phenomenon with far-reaching impacts. In these times, turning to non-traditional investment methods like buying art can be an innovative way to protect and grow wealth. However, potential investors should approach with knowledge, caution, and an appreciation for the risks involved. In other words, buy art not only for its potential to combat inflation but also for its intrinsic value, which transcends economic fluctuations.

For advice please contact Acoris Andipa on +44 (0)20 7581 1244 or sales@andipa.com